The Essential Guide On How To Buy Like A Pro

The Home Buying Process

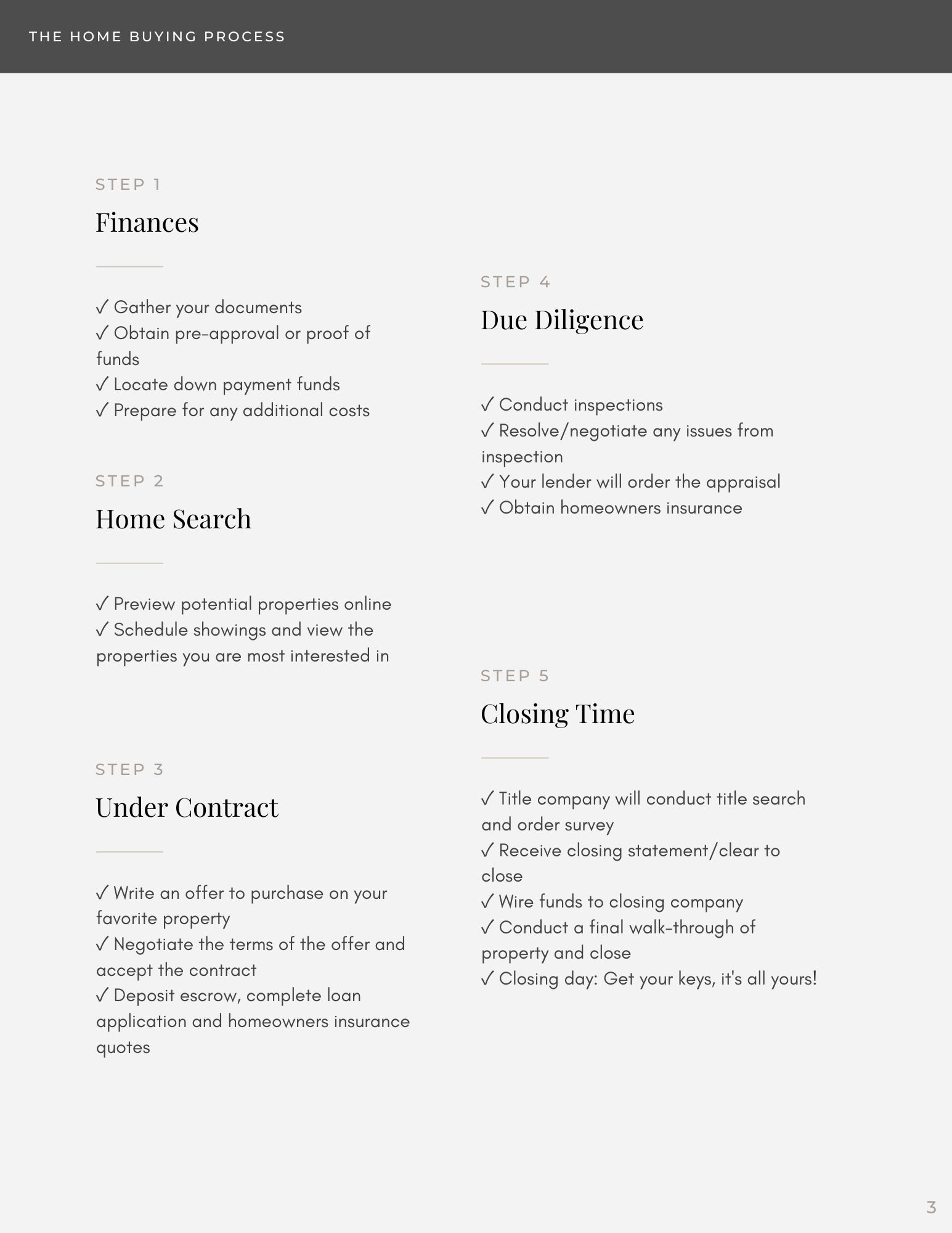

There are 5 main steps to the home buying process. This starts with determining how you are going to pay for your home, and ends with a successful close!

Step 1: Finances and Finding the Right Mortgage Lender

The very first step of the home buying process is to get a pre-approval letter from a lender stating how much you are qualified for. It's important to ask your potential lenders some questions to make sure they are a good fit for you.

Don’t understand something your lender says? Stop and ask for clarification. This is your home buying journey, and you deserve to understand the process every step of the way.

A pre-approval is only valid for 30-90 days, so while you can start talking to lenders, you’ll want to wait on getting that pre-approval letter when you’re ready to buy.

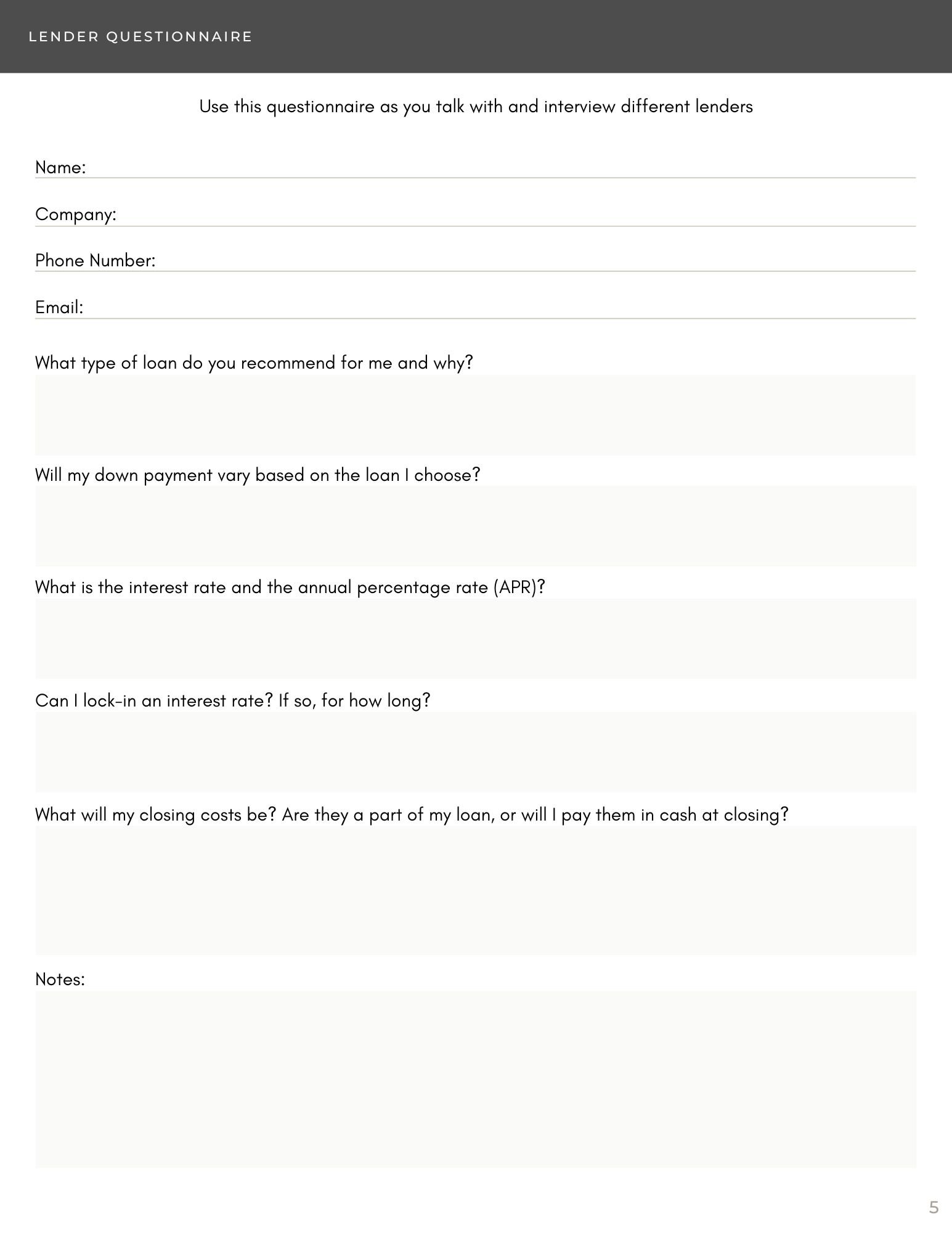

Questions to Ask Potential Lenders

1. What type of loan do you recommend for me? Why? There’s no one type of mortgage loan that’s superior to another—but whichever you choose, you need to know why it’s best and how it works.

2. Will my down payment vary based on the loan I choose? If you’re tight on cash or don’t want to be cash poor, let your lender know. Loans vary in their down payment requirements.

3. What is the interest rate and the annual percentage rate (APR)? Everyone talks about the interest rate, but the APR is just as important. It combines the interest rate with the fees a lender charges to originate your loan.

4. Can I lock-in an interest rate? If so, for how long? If you think rates will be moving up, ask if you can lock it in for a set period of time.

5. What will my closing costs be? Are they a part of my loan, or will I pay them in cash at closing? Remember, closing costs usually run 3-6% of your loan value so you need to know how they’ll be covered.

Step 2: Strategic Home Searching

Before we hop into the home search, I like to advise my clients to create a "Needs" list and a "Wants" list. This will help us to really focus on the things that are most important in your future home.

Needs are the non-negotiable features; the features you simply must have in your next home. Wants are the ones you’d like to have, but you can add or change down the road.

Don’t feel like your first draft has to be your final draft—and above all else, remember you can’t change the lot, the location, or the price you paid so spend a good amount of time thinking through those three before moving on.

Needs might be things like:

• Enough square footage for you and your family

• Sufficient bedrooms and bathrooms

• Close proximity to work and school

• Attached two-car garage

• Grassy yard for children's or pet's play area

Wants will look more like:

• Specific paint or exterior color

• Pool, jacuzzi, or other exterior water feature

• Fenced-in backyard

• Specific carpet, hardwood floors, or tile

• Kitchen amenities like countertops and appliances

• Walk-in shower or double bathroom vanity in master

Home Searching Tips

Now that you’ve got your wants vs. needs list in hand, the fun really begins! It’s time to talk about narrowing down those listings and deciding which ones to see in person. First up, let’s talk about best practices for searching online. No doubt you know the sites (Realtor.com, Zillow, Redfin, Trulia), but how can you get the results you want? Try some of these tips.

1. Use the search filters but not too much

You don’t want to restrict your search so tightly that you only have a handful of homes to view. Keeping your wants vs. needs list in mind, expand your geographic search, and add 25-50K to your max price since homes often sell under asking.

2. If you find something that catches your eye, check out the Google street view

Online pictures can be deceiving so a virtual ‘walk down the street’ will give you a better sense of the house and surrounding area.

3. Don’t shy away from a home because it is “pending” or “under contract.”

Pending contracts do fall through, so keep it on your list especially if it checks all your boxes.

After you’ve found a few homes you like, jot down the MLS number and address. Shoot the list to me and I will call the listing agents to gather pertinent info and gauge the seller’s motivation. At this point, it’s time to look at the calendar and find a chunk of time to tour the homes on your shortlist. Carve out more time than you think you’ll need since you don’t want to be rushed if you find a home that may be “the one.”

Making the most of your showings

You’re SO READY to get inside those homes on your shortlist and see for yourself if one of them is soon-to-be your new address. I know you’re excited, but you gotta go into those showing calm, cool, and with your thinking cap on. Here’s a quick list of how to do just that:

Before a showing, read over your wants vs. needs list and revisit your budget.

Having this fresh on your mind will help you stay objective and focused. Take pictures and videos to jog your memory later and to help you process with friends and family.

Remember, you can’t change the lot or the location so make sure you love both.

You also don’t want to be the priciest home on the block. I will help you assess whether or not that’s the case.

Don't let yourself get distracted by decor or staging.

These things will be gone by the time you move in, so try to stay focused on the things that cannot be changed as easily.

Take your time.

If a home makes a good first impression, let me know you’re interested and that you’d like to spend a bit more time looking around. This is one of the largest purchases you’ll ever make so it’s worth it to learn as much as you can while you’re there.

Tips for Making an Offer Stand Out

So you think you’ve found “the one” and you’re ready to put in an offer—one that will be simply irresistible to sellers. Let's talk about making an offer that stands out.

- Include a pre-approval letter that shows that you’re serious, qualified, and ready to purchase.

- Use a friendly tone. Let sellers know you want their home—and that you’ll be easy to work with all the way to closing.

- Put your best foot—and price—forward. You may only get one shot, so make it count. Use comps and trends as a guide, but go in with a strong number you know a seller would find favorable.

- If you can pay “all cash,” say so. When you don't need financing, your offer is less risky for anxious sellers.

- Propose to close quickly and only include contingencies if you must.

- If you really want to make an impression, include a short hand-written note with your offer. Sometimes it’s the smallest gestures that have the most significant impact.

And of course, when you’re ready, I will guide you through putting together an offer that gives you every advantage in landing the home of your dreams.

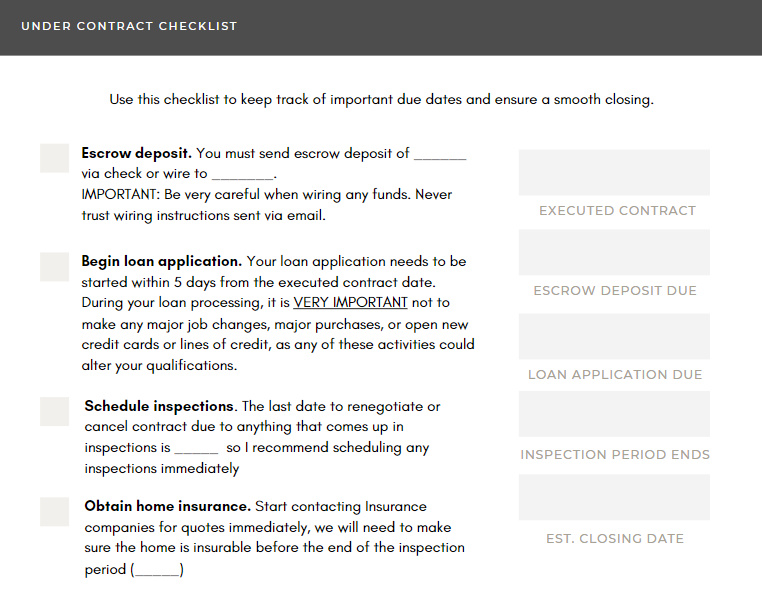

Step 3: Under Contract

We're under contract... now what?

You made an offer, and it has been accepted—go ahead, cue the confetti! And while it’ll be a few more days until you can move in, you’re well on your way to closing the deal on your new home sweet home.

Here's a quick rundown on what happens after you make an offer and your new home is “under contract.”

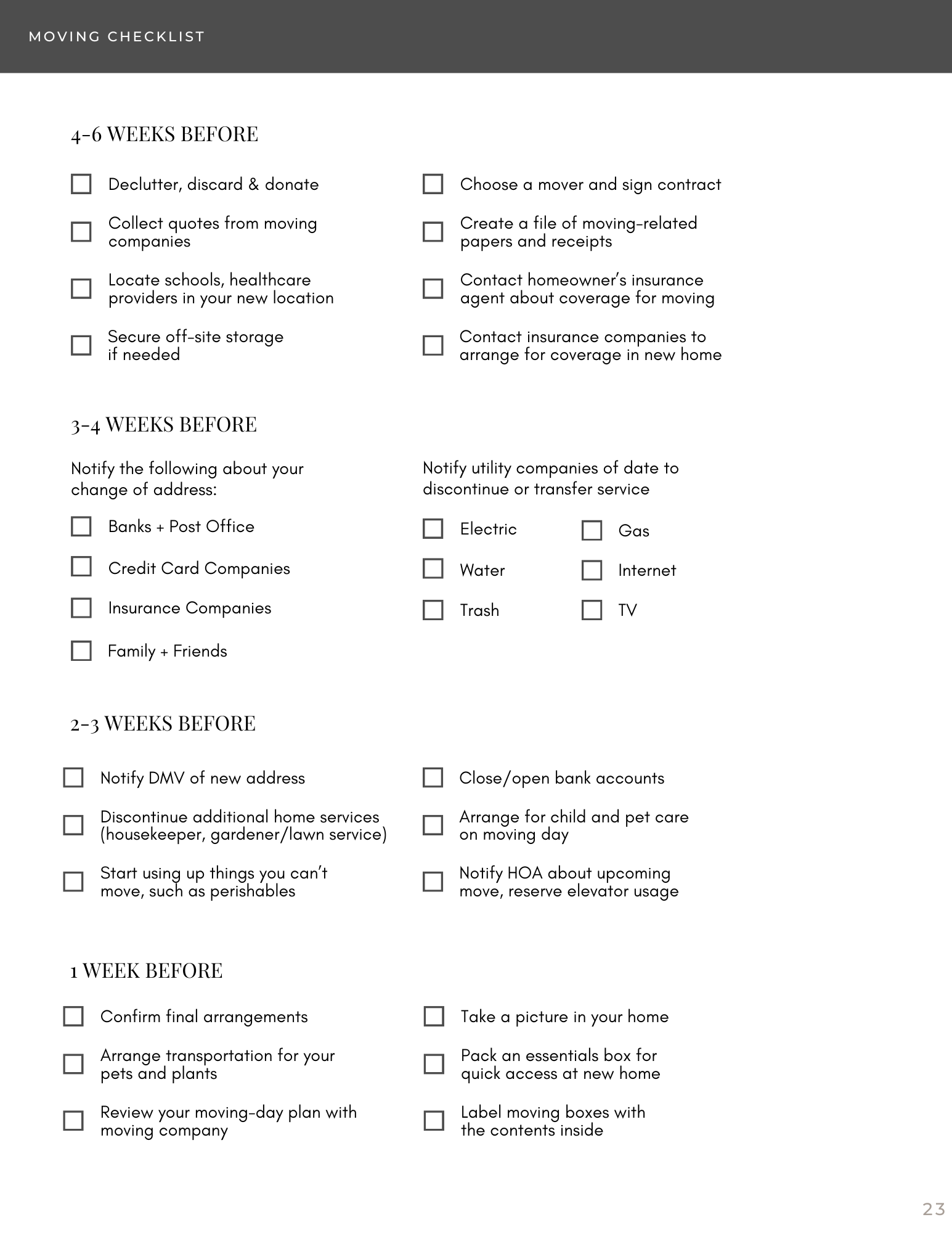

- First, I will carefully review important dates and information you will need to know to ensure a successful closing. Check out the checklist on the following page to get all of your need to know information & important dates.

- You’ll need to meet with a mortgage lender to firm up financing details and lock in your interest rate.

- Once the home inspection report comes in (and you should definitely request a home inspection), we may need to negotiate any repairs with your seller.

- Towards the closing date, you’ll get a call from your closing attorney’s office to schedule your closing.

Step 4: Due Diligence

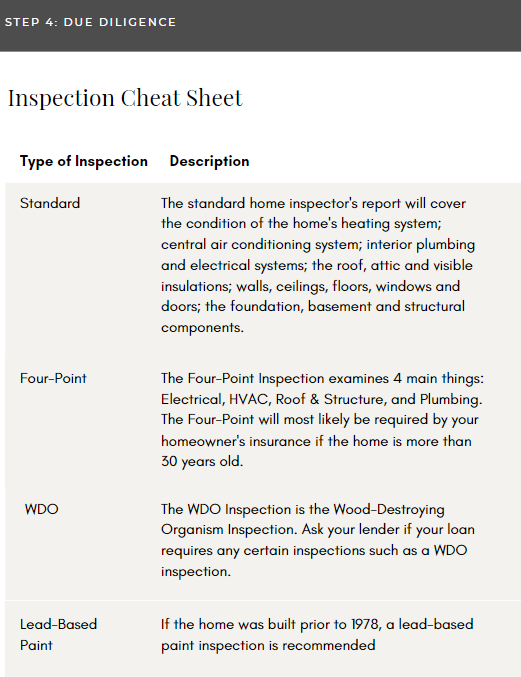

All About Home Inspections and Insurance

What is a home inspection?

The inspection will uncover any issues in the home that would have otherwise been unknown. You will receive a written report of the inspection. I recommend that you are present for the inspection, so that you may ask the inspector any questions.

What does "inspection period" mean?

During the inspection period, the buyer has the right to hire a professional to inspect the condition of the home. If the results on the inspection report comes back with any issues that need to be addressed, the buyer may ask the seller to cover the costs of these repairs, reduce the sales price, or fix the repairs before closing. If an agreement can not be made, the buyer has the right to back out of the contract and get the escrow deposit back with no consequences.

The home seems fine, do I really need a home inspection?

You may think the home is in perfect shape, but some of the costliest problems are difficult to spot: leaks, termite damage, foundation issues, poor ventilation, faulty wiring, and drippy appliances. A home inspection gives you the chance (before you sign on the dotted line) to have a professional inspector see if there are any problems that need to be addressed, replaced, or fixed.

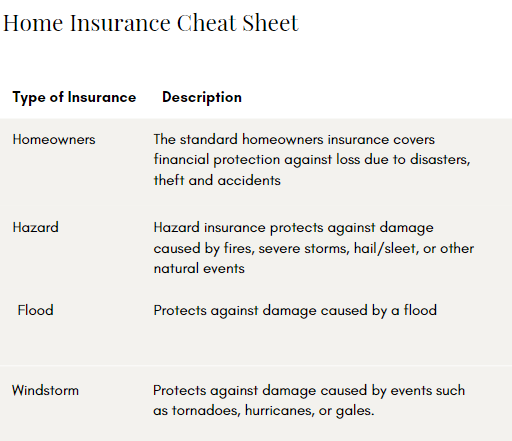

If you are getting a loan, the lender will require you to obtain home insurance. The home insurance company will typically require that you have certain inspections done. In order to obtain insurance, the inspection reports will need to fit the criteria of the insurance company. This is another reason that you may need to have an inspection done.

Step 5: Closing Time!

Pre-Closing

We are so close to the closing table! Here's what's going to happen leading up to you receiving the keys:

- Under Contract

- Inspections

- Obtain Insurance

Appraisal

An appraisal is an estimate of the value of the property by a licensed professional appraiser. Once any problems during the inspection are solved, the appraisal will be ordered by the lender and paid for by you. The goal of the appraisal is to verify the value of the property for the lender and to protect you from overpaying. The contract is contingent upon whether the appraisal comes in at or above the purchase price. If the appraisal comes back short, we will be back to the negotiating table.

Obtain Mortgage

You have 5 days from the date of contract execution to begin the mortgage loan application.

During the 30-45 days before closing, the lender will be finalizing your mortgage.

It is very important not to make any major job changes, major purchases, or open new credit cards or lines of credit, as any of these activities could alter your qualifications for a loan.

Survey

Unless the seller already has a recent & acceptable survey of the property, the buyer is required to pay for the survey (this will be in your closing costs). The title company or I will order this for you. The survey is a sketch showing a map of the property lines/boundaries among other things. The survey will show if there are any encroachments on the property.

Title

The title company will conduct a title search to ensure the property is legitimate and find if there are any outstanding mortgage liens, judgments, restrictions, easements, leases, unpaid taxes, or any other restrictions that would impact your ownership associated with the property. Once the title is found to be valid, the title company will issue a title insurance policy which protects lenders or owners against claims or legal fees that may arise over ownership of the property. This will also be a part of your closing costs.

Clear-to-Close!

The magic words! It means the mortgage underwriter has officially approved all documentation required to fund the loan. All that remains is the actual closing process.

Closing Time!

You've gotten the "clear-to-close" and we've scheduled our closing date and time – let's answer some questions you may have about closing day:

Q: When do we do the final walk-through?

A: The final walk-through is exactly what it sounds like – it allows the buyers to do one last walk through before closing to confirm that the seller made the repairs that were agreed upon and to make sure no issues have come up while under contract. We will typically schedule to do this right before closing.

Q: Who will be at closing?

A: Situations vary, but you can expect some combination of these folks: Buyer (that’s you!), seller, real estate agents, closing agent/attorney, and sometimes the mortgage lender.

Q: What will I do?

A: Stretch those fingers and get ready to sign, sign, sign. At closing, the seller will sign ownership of the property over to you, and you’ll sign to receive possession.

Q: What should I bring?

A: Bring a photo ID and a cashier’s check to pay any closing costs. Your agent will tell you any other documents specific to your situation. The closing process is relatively simple but be prepared for A LOT of paperwork. (And always, always, always ask if you have a question along the way.) The good news is once you’ve signed the last page, it’s time to get a hold of those keys and celebrate!

Bottom Line

The job of a trusted real estate professional is to give you the best advice possible.

We use our knowledge of the homebuying process to explain both the national headlines and what’s happening in our

local area. That way, you have the best of both worlds and can feel confident in your decision to buy a home.

With our expertise, we can anticipate what could happen next and work with you to put together a solid plan. Then,

we'll guide you through the process, helping you make decisions along the way. That’s the very definition of getting the best – not perfect – advice. And that’s the power of working with a real estate advisor.